Our client, a food retailer company, deals every day with several SKUs (Stock Keeping Units) throughout its warehouses, trucks and stores. Considerable efforts were spent on optimizing inventory levels in the whole distribution system. However, one important factor was often ignored: the choice of the Case Pack.

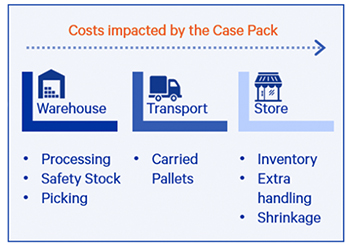

The definition of the Case Pack – transportation unit from supplier to distribution center and later to stores – is an underestimated process that may have a large impact across the entire supply chain. An ill-defined quantity leads to additional efforts in the chain and, consequently, it impacts the bottom-line.

Several cost components needed to be modeled, in order to properly define the impact in the whole supply chain. Afterwards, the optimal quantity arose from the trade-off of the different costs.

At a warehouse level, the processing and picking costs were modeled according to the handled boxes specifications as well as the safety stock needed in the warehouses. In addition, at a store level, the inventory and shrinkage costs were further modeled in agreement with the Case Pack quantity.

Alongside, several product attributes such as seasonality and packaging attributes were also integrated in the developed model.

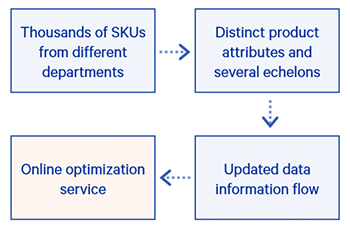

In a first moment, we focused on conceiving an appropriate and robust methodology according to the several distinctive SKUs’ attributes.

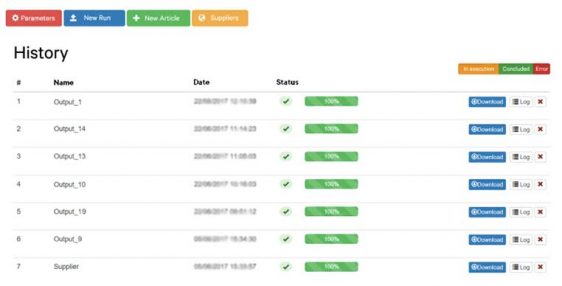

This methodology translated the developed cost model into an online optimization service enabling a more reliable and effortless process to optimize the Case Pack.

Today, the main recommendations constitute guidance in the negotiation with suppliers to steer the Case Pack towards the optimum. The robustness and modularity of the developed methodology has enabled the deployment of a service to periodically revise the Case Pack quantities.