A large convergent telco, originated from a recent merger of fixed and mobile providers, faced the need to redesign and unify two separate multi-echelon supply chains. The interdependency between various planning levels (procurement, marketing and production) made process integration critical. A robust decision support system was required to tackle this complex environment, characterized by demand uncertainty, fluctuating marketing strategies, powerful suppliers and intricate direct and reverse logistics, with over 200 simultaneous flow types.

The goal was to capture operational synergies, reduce inventory costs and increase the reuse of refurbished equipment, while maintaining superior customer service.

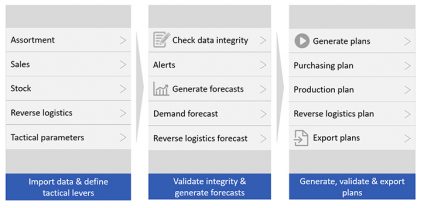

An holistic framework was conceived to connect the multiple decision levels and distinct business areas into a single workflow. This unified planning model was materialized with a decision support system for demand planning, purchasing, production and reverse logistics.

The model leverages both predictive and prescriptive analytics. Upstream, a new forecasting methodology combines historical data with marketing sensibilities.

Demand estimations are then a key input for a state-of-the-art stock management approach, designed to meet desired service levels while dealing with multiple time horizons: production and reverse logistics plans are created on a weekly basis, while procurement lead times require a long-term vision.

The project has ultimately generated a fully customized decision support system (DSS). With a user-friendly interface and comprehensive alerts that ensure data integrity, the DSS is a robust reliable tool.

Short processing times allow for exploring multiple scenarios, while decreasing planning expenses by ~50%. Robust plans induce a reduction of ~10% in stock coverage and an increase of ~10% in equipment re-usage rates.