With more than 19 days of stock coverage in several warehouses and a necessity to sustain high service levels, the changes in inventory management were crucial but highly risky.

After an initial diagnosis, it was clear that there was a replenishment and transshipment policy that was not adjusted to their business setting and a lack of transparency within the purchasing and distribution processes.

This scenario posed the right opportunity to develop a project in which success meant a very fast return on investment. With the help of our analytical thinking, it was possible to undertake such endeavor.

Through a simulation-based approach, we were able to test new inventory strategies and policies that were fine-tuned to the company’s reality.

These new policies included the explicit acknowledgment of a dynamic demand variability, the multi-echelon and multi-site nature of the company, as well as the service level differentiation between products and clients.

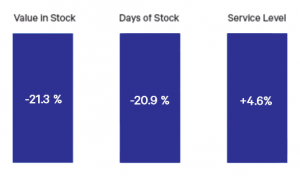

Besides the ability to help us fit the policies, a simulation was also vital for a smooth implementation without any service drawbacks. In less than three months, the company had a fully operational replenishment policy with straightforward results: a stock reduction of more than 20% and a slight increase in service level.