Almost three years after the European Union referendum, and an elusive deadline for leaving the union, the impact that the United Kingdom decision to leave the EU has had on the economy so far is notorious. Businesses are recognizing that this is and will be an era of prolonged and heightened macroeconomic and political uncertainty, impacting operations on the wider continent.

This case takes us to a textile manufacturing plant shared by an Anglo-Portuguese joint venture. In an effort to hedge against Brexit, the firm aimed at increasing its output in Portugal as a way of facilitating its way into the EU market.

The challenge at hand was to explore the potential of establishing a partnership with a nearby plant to share volume and reap the most benefits from the business relocation strategy.

Having cost and available capacity as a proxy for a joint venture potential, a thorough mapping of industrial flows and industrial expenses was conducted. The findings poured into a detailed Digital Twin of the targeted factory.

After being fine-tuned with a year of past orders, the simulator was accurately able to portray the flow of production orders, and costs arising therefrom, placing a price tag on the HR, chemicals, utilities and overhead of each single operation.

The accuracy of the simulator provided a comfortable estimate of the impact of new orders, which revealed itself in potential bottlenecks and economies of scale.

The simulator outputs made clear which sectors of the plant were able to accommodate additional volume and which were not. An uneven utilization of the different sectors by different product families allowed for an optimal selection of the orders to outsource.

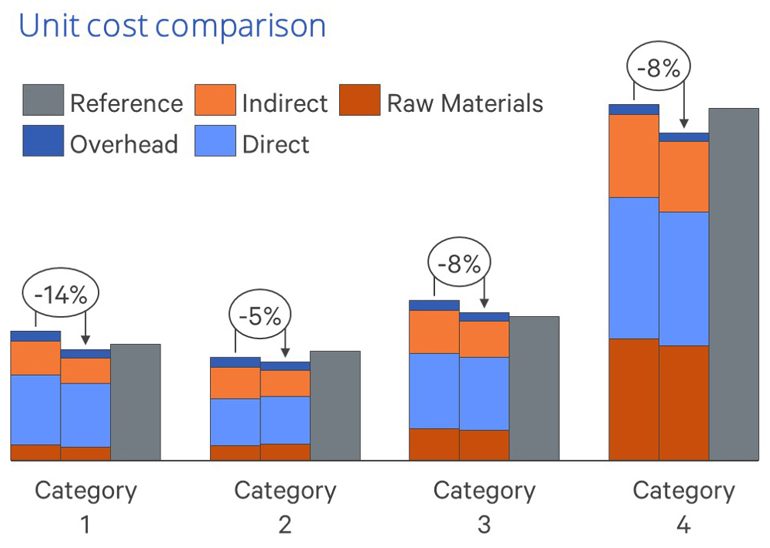

Moreover, an increase in average order size led to an estimation of up to 14% in unit cost reduction, depending on the product category.

Aside from the identified opportunities, along with a set of recommendations for investment in equipment and improvement in management control practices, both the client and the incumbent were left with an operations simulator that could assess different scenarios of demand and synergy options in the future.

This case makes the statement that simulation is undoubtedly part of the palette of tools available for due-diligence, and that there is value to be realized for the Portuguese industry from an agitated geopolitical frame.

By: Pedro Schuller